Downsize or Stay Put? The Midlife Retirement Home Decision Checklist (Without the Regret Spiral)

A wise, practical way to decide what to do with the house — and protect your future freedom along the way.

Hello my dear friend,

If you’ve ever stared at your home and thought:

“It’s too big… but it holds all our memories.”

“We could free up money… but where would we go?”

“What if we make the wrong decision?”

Welcome, love. You’re normal.

Housing is emotional.

Housing is financial.

Housing is family.

Housing is future-care.

So, no — this is not a casual decision made after two TikToks and a stressful Sunday.

Quick note: This is general information, not personal financial advice. Consider professional advice for your specific situation.

First, let’s name what this decision is really about

It’s rarely just “downsizing.”

It’s usually about one (or more) of these:

reducing money stress

lowering maintenance and overwhelm

preparing for health changes

being closer (or further!) from family

freeing up cash flow

building a retirement lifestyle you actually want

So, here’s what we’re doing:

We’re choosing freedom — not reacting to fear.

The Midlife Home Decision Checklist (save this!)

1) How does your home feel in your body?

Yes, I’m asking that.

When you think about staying, do you feel:

calm?

heavy?

trapped?

secure?

When you think about moving, do you feel:

excited?

anxious?

relieved?

grief?

Action: Write two lists:

“What I love about this home”

“What this home costs me” (money, time, energy)

Both count.

2) What’s the true cost of staying?

Not just your mortgage.

Include:

rates/council tax, insurance

repairs (roof, hot water, appliances)

utilities

renovations you’ll “need eventually”

transport costs based on location

Action: Estimate the annual cost of staying.

Midlife planning loves honesty.

3) What’s the true cost of moving?

Downsizing is not always cheaper short-term.

Consider:

selling costs

moving costs

storage (temporary or ongoing)

potential renovations in the new place

fees/taxes (depending on your country)

Action: Don’t romanticise moving.

Price it properly.

4) Do you want space — or do you want ease?

Sometimes we keep the big house because we love hosting.

Sometimes we keep it because we’re scared of change.

Sometimes we keep it because it’s our identity.

Ask:

Would I prefer a smaller home with more money for life?

Or a bigger home with less cash flow — but more space?

Neither is morally superior.

But one will suit your season better.

5) What does “future-care” look like for you?

Hard question, but wise women ask it.

Think:

stairs and mobility

bathroom safety

proximity to healthcare

proximity to trusted people

ability to maintain the property if health shifts

Action: If you intend to stay long-term, consider what would need to change to make it safe and manageable.

6) Are you using the house as a retirement plan… without meaning to?

Sometimes we’re “house rich, cash flow stressed.”

That can feel okay while you’re earning.

It can feel very different later.

Ask:

Do we have enough cash flow for daily life?

Are we relying on “selling one day” but have no plan?

Action: If your house is your Plan A, you need a Plan B too.

7) The mortgage vs retirement savings dilemma (again!)

If you’ve got a mortgage, this matters:

Paying down the mortgage can reduce monthly pressure.

Building retirement savings can increase future income security.

Practical framework:

If cash flow is tight → reduce pressure first

If retirement savings are thin → increase contributions steadily

If you can do both → split the difference

Most midlife women don’t need a perfect strategy.

They need a strategy they’ll stick to.

8) Don’t forget the “adult kids and grandkids” factor

Some women downsize and feel free.

Others downsize and realise:

they’ve lost the gathering place

hosting feels harder

distance from family matters more than expected

Action: Ask yourself:

“What role do I want home to play in our family story over the next 10 years?”

That answer is gold.

9) Try a “downsizing rehearsal” before you sell anything

This is my favourite practical trick.

Do a 30-day rehearsal:

declutter one room per week

sell/donate what you truly don’t need

track what you never touch

reduce your living space intentionally

At the end, ask:

Do I feel lighter?

Or do I feel like I’m deleting my life?

That will tell you a lot.

A simple decision matrix (so emotions don’t hijack the whole thing)

Give each statement a score from 1–5:

Staying supports our lifestyle and health.

Staying is financially sustainable long-term.

This home still feels like “us”.

Moving would significantly reduce stress.

Moving would improve our daily life.

Moving would strengthen our future plans.

If “moving” scores higher overall, you’ve got a clue.

If it’s mixed, you may need a staged plan — not an all-or-nothing leap.

You don’t need to rush this.

But you also don’t need to avoid it for another five years.

Midlife is the season for wise decisions — the kind that protect your peace and your options.

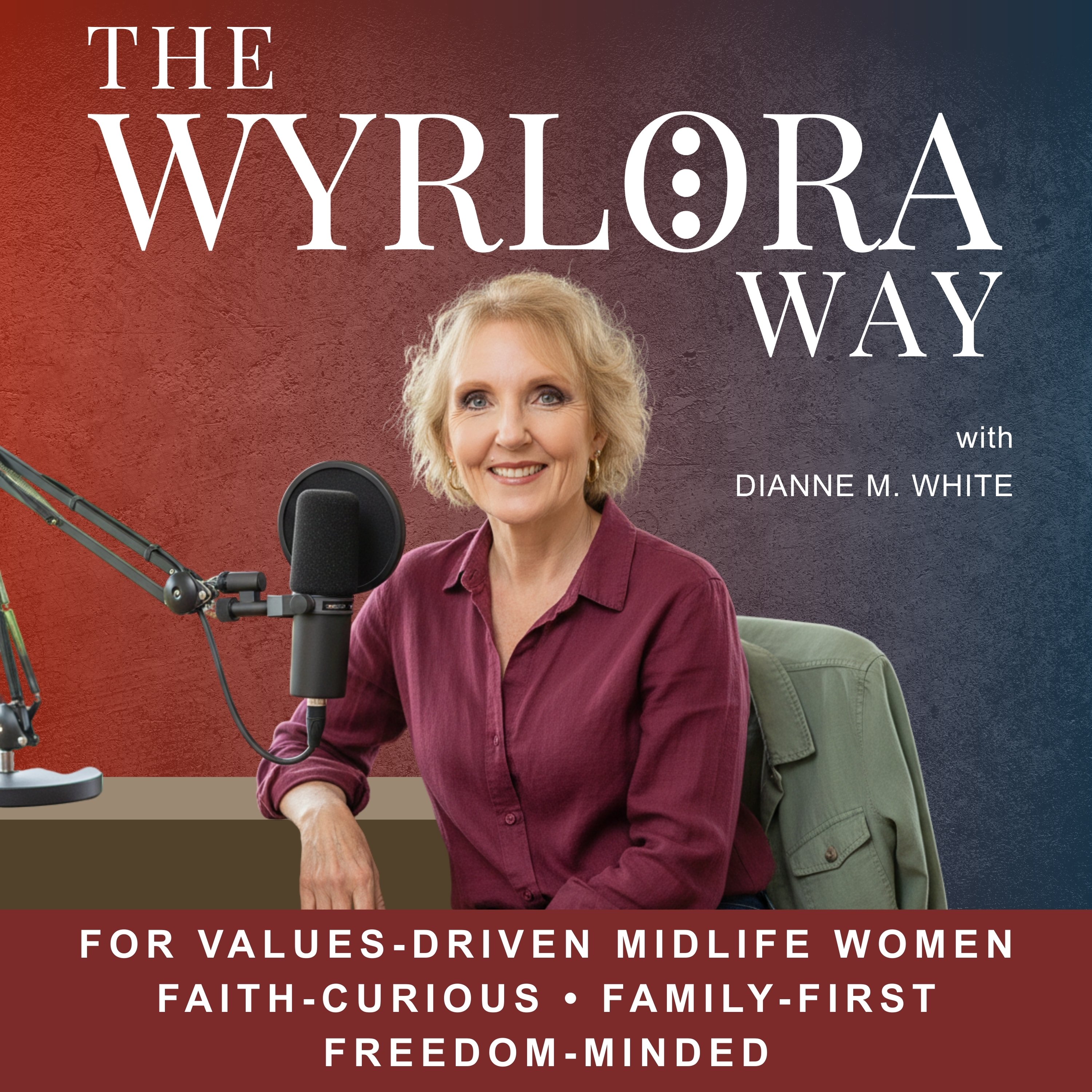

If you’re building your freedom years with intention, read the next Money & Retirement post, join the WYRLORA Circle, or subscribe to the WL Message for steady encouragement and practical steps.

Until we chat again,

Blessing & hugs to you my dear friend,

Dianne xx